Dear Valued Client,

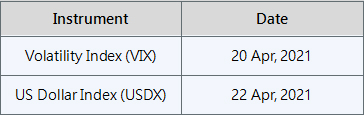

To provide a broader portfolio of products, Pacific Union will permanently switch our Volatility Index Cash & US Dollar Index Cash to Volatility Index Futures & US Dollar Index Futures from 20th April 2021 and 22nd April 2021 respectively. Adjusted Futures contract positions will then not be subjected to Overnight Financing charges afterwards.

Any open positions on Volatility Index Cash and US Dollar Index Cash will then be held on a rollover adjustment if you hold over the contract expiration dates, the comment in the balance will be“Cash Adjustment-Rollover”.

All open positions will be charged rollover adjustment charges on the expiration date listed in the table below:

*All hours are provided in GMT+3 (Server Time in MT4/MT5.)

To avoid rollover adjustment charges, clients may choose to close any open positions of VIX before the market closes on 19th April 2021, and USDX before the market closes on 21st April 2021.

Please note:● The rollover will be automatic, and any existing open positions will remain open.● Positions that are open on the expiration date will be adjusted via a rollover charge or credit to reflect the price difference between the expiring and new contracts.● Clients should ensure that take profits and stop losses are adjusted before this rollover occurs.

During this product switching period, please carefully evaluate the risks that may arise and trade with caution.

If you have any questions or require any assistance, please contact our support team viaLive Chat, email: [email protected], or phone +248 4671 948.